February 27, 2025

December 17, 2024

December 12, 2024

November 20, 2024

November 20, 2024

November 4, 2024

April 22, 2024

February 29, 2024

February 14, 2024

February 14, 2024

October 24, 2023

October 9, 2023

April 28, 2023

February 28, 2023

November 11, 2022

July 11, 2022

April 23, 2022

April 1, 2022

February 14, 2021

May 28, 2021

May 26, 2021

May 26, 2021

April 6, 2021

March 1, 2021

September 8, 2020

June 3, 2020

May 21, 2020

May 18, 2020

December 13, 2019

December 13, 2019

February 7, 2018

February 1, 2018

December 20, 2017

Medium: How to Win in Micro VC - Accolade Partners

In the business of investing, ownership matters - a lot! At Accolade Partners, a private equity fund of funds, we believe that portfolio company ownership is a significant driver of returns in the Micro VC market. The VC model is predicated on exits: either write downs (which nobody wants), secondaries (albeit not a common option yet), IPOs or M&A.

November 1, 2017

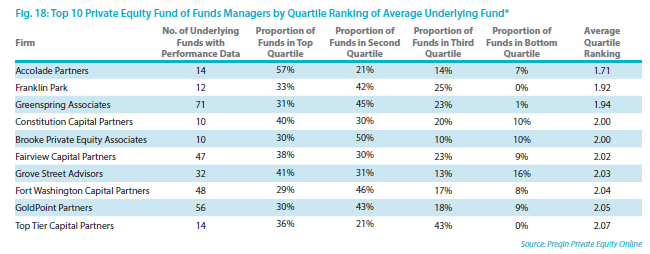

Preqin's Private Equity Fund of Funds Report ranks Accolade Partners the #1 Fund of Funds Manager.

Accolade Partners, a Washington DC-based firm specializing in investments in venture capital and growth equity investments, leads the field with an average quartile ranking of 1.71.

July 10, 2017

May 31, 2017

April 26, 2017

February 17, 2017

Sun Basket cooks up another $15 million for gluten-free and paleo meal kits

Meal kit delivery startups, at this point, are nothing new. They send pre-measured ingredients in an insulated package right to a subscriber's door, and promise to alleviate the inconvenience of grocery trips. One company in this burgeoning channel of food retail, Sun Basket, has just raised $15 million in a Series C round of venture funding to put a health-conscious twist on the meal kit.

December 19, 2016

May 3, 2016

Origins - Episode 5 - Notation Capital And Joelle Kayden, Accolade Partners

Joelle Kayden, Accolade's founder and Managing Member, discusses her experience in the tech IPO market of the 90's, founding Accolade Partners and closing their first fund 2 weeks before the tech market crash of March 2000, and the evolving venture and and LP landscape.